http://tiger.pbcom.com.ph/index.php/personal/auto-loan

Retail Treasury Bonds

Retail Treasury Bonds (RTBs) are medium to long-term investments issued by the Philippine government through the Bureau of Treasury. These bonds carry minimal risk and are originally issued with tenors of 3 to 25 years. They form part of the Government’s program to make Government Securities available to retail investors.

Features and Benefits

- Low-risk investment

- Higher interest rates compared to other financial instruments

- Can be easily bought or sold in the secondary market through SEC-licensed Fixed Income Salesmen

- Interest payments are credited either quarterly or semi-annually to your PBCOM account

- Interest earned is guaranteed by the Republic of the Philippines regardless of price fluctuation during the life of the bond

- Available to individual and corporate accounts (i.e. corporations, banks, trust, insurance, etc.)

Requirements

PBCOM Requirements

- Account Opening Requirements with PBCOM (signed CIF/ROF)

- Secretary Certificate, if corporate account

- Client Sustainability Assessment Form

- Risk Disclosure Statement

Third-Party Custodian Requirements

- Notarized and signed Special Power of Attorney (SPA) to open custody account

- Letter of Instruction (LOI) to 3rd party custodian

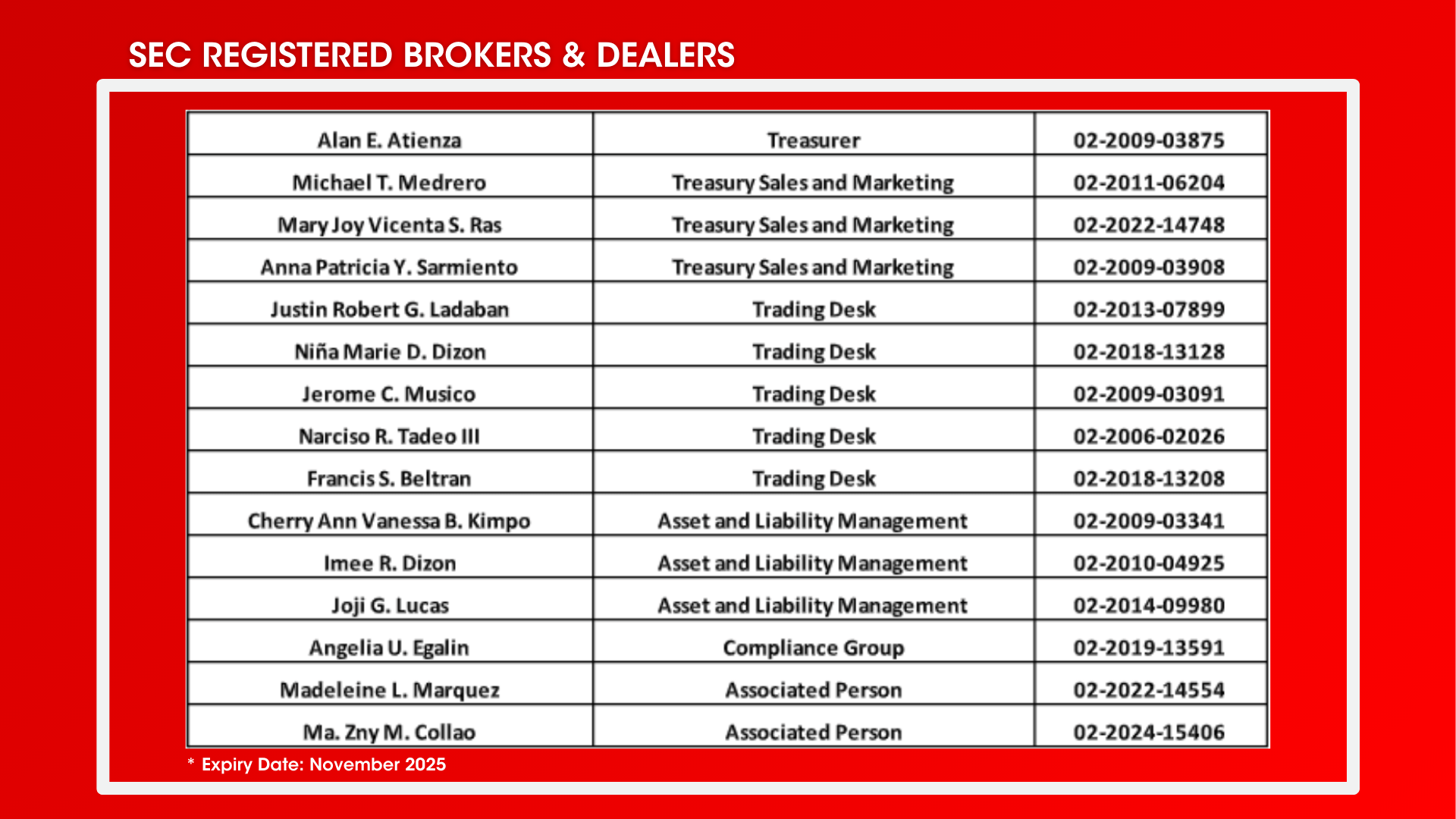

SEC Licensed Fixed Income Market Salesmen

Risks

These bonds carry minimal risk and originally issued with tenors of 3 to 25 years.